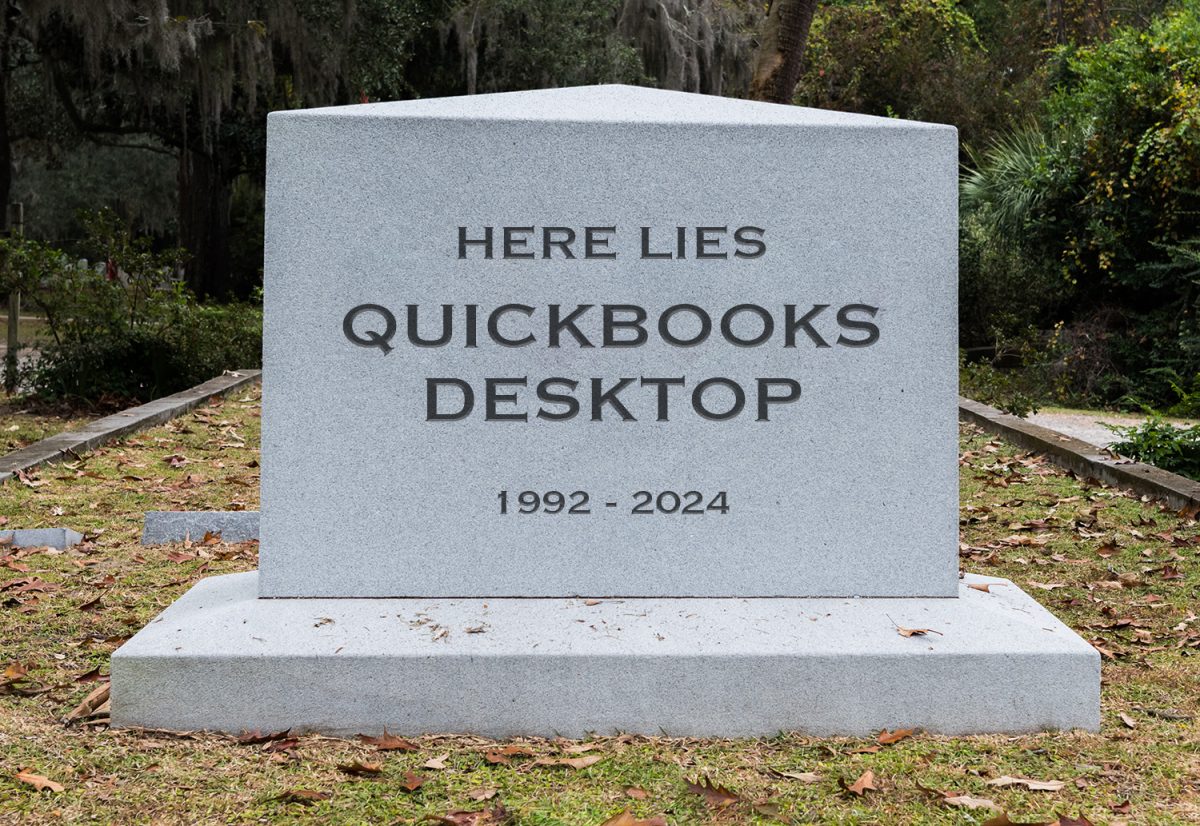

by Debbi Silva If you’re on QuickBooks Desktop Pro or Premier, you’ve likely already heard about Intuit’s plan to phase out the …

Cash Flow Forecasting 101 (and Tips for Organizations Using QuickBooks)

By: Jeff Heybruck Forecasting cash flow is one of the most difficult but impactful planning exercises a business owner can undertake. There …

Small Business Tips to Negotiate Better Payment Terms & Conditions with Customers

By: Jeff Heybruck Net 30? Yeah, right. AR from large clients can be tricky. A common refrain we hear from small business …

QuickBooks Integrations: A Checklist To Successfully Plan Your Next Integration

By: Jeff Heybruck In addition to reducing tedious, duplicative data entry across multiple systems, integrating apps with QuickBooks can enable real-time financial …

QuickBooks Desktop 2024: What’s New & Different

By: Debbi Silva The 2024 release of QuickBooks Desktop brings a few notable updates and changes. As our accounting software of choice …

Is QuickBooks Desktop Being Phased Out? – Your FAQs Answered

Heard the buzz about QuickBooks Desktop being phased out, but aren’t sure what that means for your organization? Our Lucrum QuickBooks experts …

The Power of QuickBooks Custom Reports: Real-World Use Cases

Out-of-the-box reports in QuickBooks are a great starting point, but QuickBooks custom reports are the key to creating actionable financial dashboards. We …

Comprehensive Year-End Accounting Checklist

By: Jeff Heybruck Fall is an opportune time for businesses to get 2023 financial documents in order and plan strategically for the …

Advantages of QuickBooks Desktop vs. Online

By: Jeff Heybruck While QuickBooks Online has gained popularity for its accessibility and cloud-based convenience, QuickBooks Desktop continues to be a strong …

QuickBooks Setup Dos & Don’ts For Actionable Reporting

By: Jeff Heybruck Whether running a salon with multiple locations or managing a services business across territories, proper QuickBooks setup is crucial …

Budgeting in QuickBooks 101: Create A Budget In QuickBooks

By Jeff Heybruck Short on time? Take me to the key takeaways. Business owners who fail to spend at least one day …

How To Score & Rank Your Customers: Stratifying A Client Base

By: Jeff Heybruck Not all clients are created equal. Some are more profitable than others, and some are just plain difficult to …

Counterintuitive Small Business Advice

by: Jeff Heybruck Sometimes the best advice isn’t the most obvious. Our CFOs have learned a thing or two about how to …

5 Signs You’re Ready for a Fractional CFO

By Jeff Heybruck Thinking about hiring a fractional CFO, but not sure if the business is ready? While there’s no magic business …

Job Costing in Quickbooks: Setup Tips & Best Practices

by Jeff Heybruck Job costing, or the process of tracking the costs and expenses associated with a specific job, project or account, …

How To Run A Business In the Face of Rising Interest Rates

by Jeff Heybruck Beginning in 2008, financial crises drove down interest rates to just above 0%. Now, for the first time in …

Owner’s Draw vs. Salary : How Should I Pay Myself & What Are The Tax Implications?

By: Jeffrey Heybruck We’ve seen a lot of confusion around the concept of an owner taking a draw from the company, what …

8 CFO Tips for Annual Budget Management

By: Lucrum Staff New year, new budget. Now what? Creating an annual budget serves as a firm foundation, but effective budget management …

Buying An Electric Vehicle Through A Company: Frequently Asked Questions (FAQs)

by Bailey McRae Considering buying an electric vehicle through your company? With more and more companies like Amazon investing in electric delivery …

Lucrum Year In Review

As 2022 comes to a close, we wanted to take some time to reflect on this past year. We are excited to …

Small Business Use of Vehicles FAQ: ‘Ask The Experts’

By: Lucrum StaffNovember 2022 This is our fifth installment of our ‘Ask The Experts’ series (check out our first, second and third …